Mumbai, July 19, 2025 — YES BANK reported a robust financial performance for the quarter ended June 30, 2025 (Q1FY26), registering a 59.4% year-on-year (YoY) increase in net profit to ₹801 crore. This marks the seventh consecutive quarter of profit improvement for the private sector lender.

Key Financial Highlights:

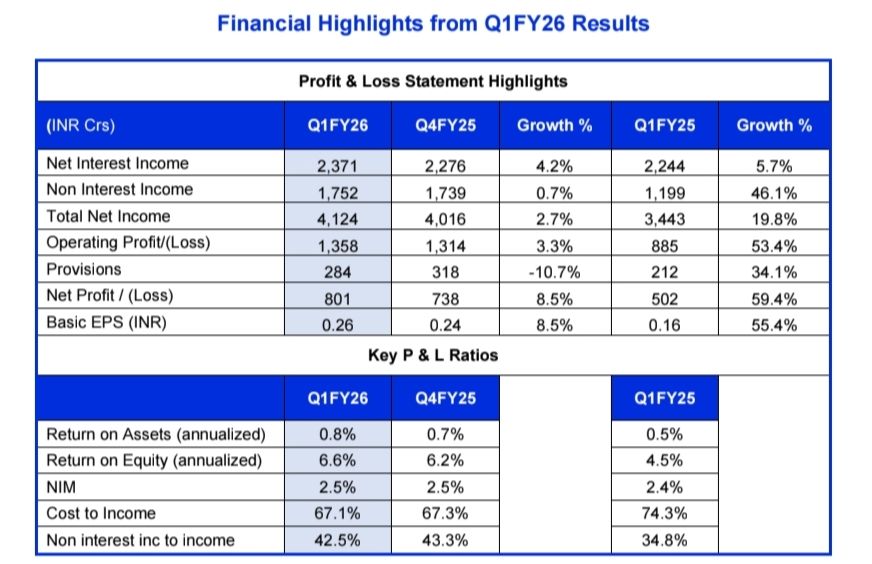

Net Profit: ₹801 Cr, up 59.4% YoY and 8.5% QoQ

Operating Profit: ₹1,358 Cr, up 53.4% YoY

Net Interest Income (NII): ₹2,371 Cr, up 5.7% YoY

Non-Interest Income: ₹1,752 Cr, up 46.1% YoY

Return on Assets (RoA): 0.8% vs. 0.5% in Q1FY25

Net Interest Margin (NIM): 2.5%

Cost-to-Income Ratio: Improved to 67.1% from 74.3%

🏦 Balance Sheet Metrics:

Net Advances: ₹2.41 lakh crore, up 5.0% YoY

Commercial Banking: +19.0% YoY

Micro Banking: +11.2% YoY

Total Deposits: ₹2.76 lakh crore, up 4.1% YoY

CASA Ratio: Improved to 32.8%, up 200 bps

Retail & Branch Banking Deposits: +20% YoY

CET-I Ratio: Strengthened to 14.0%

CRAR: Stable at 16.2%

🧾 Asset Quality:

Gross NPA: 1.6%, down 10 bps YoY

Net NPA: 0.3%, down 20 bps YoY

Provision Coverage Ratio (PCR): Improved to 80.2%

Gross Slippages: ₹1,458 Cr, with recoveries and upgrades of ₹1,170 Cr

Restructured Advances: Significantly reduced to ₹378 Cr (~0.2% of advances)

🔔 Strategic Highlights:

Global financial player Sumitomo Mitsui Corporation Bank (SMBC) entered into a definitive agreement to acquire ~20% equity from SBI & other banks.

Credit rating upgrades by Moody’s, CARE, and ICRA, highlighting improved financial fundamentals.

Recognized as one of India’s Best Workplaces in Banking 2025 and honored for Fraud Prevention & Grievance Management by the Finance Ministry.

📌 Summary:

YES BANK’s Q1FY26 performance reflects a steady turnaround with strong profitability, stable asset quality, and continued retail and CASA growth. Strategic partnerships and improved investor confidence position the bank for long-term growth.

FOR QUICK BANKING UPDATES

FOR QUICK BANKING UPDATES

Leave a Reply