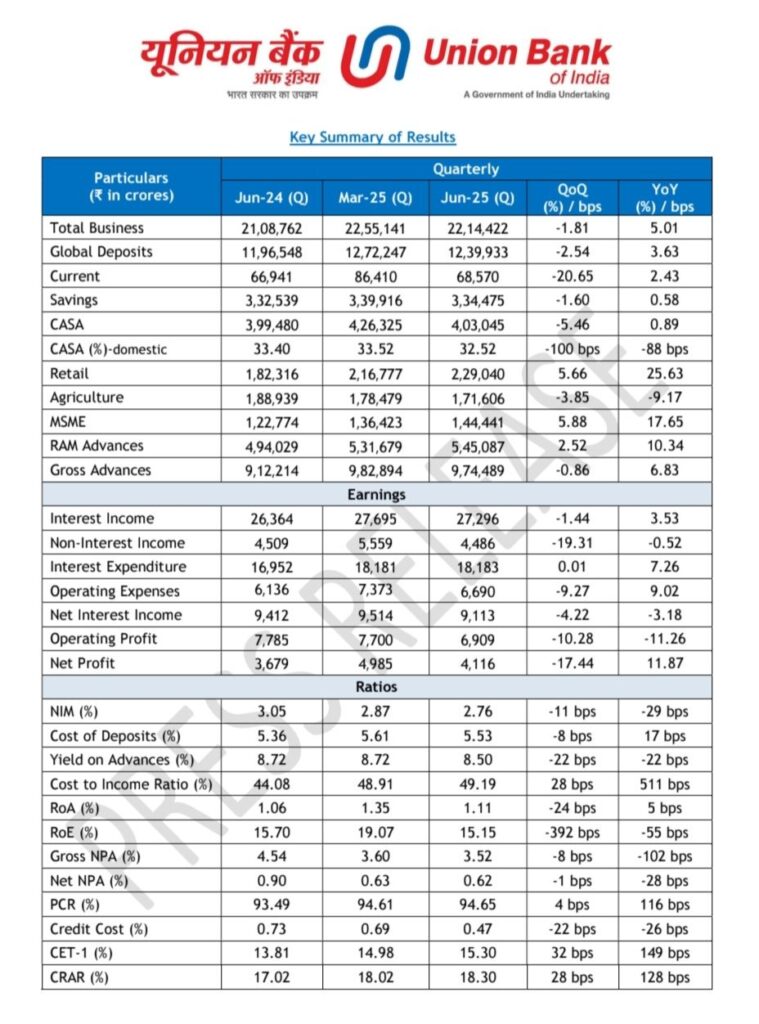

Mumbai, July 19, 2025 — Union Bank of India reported a strong financial performance for the quarter ended June 30, 2025 (Q1FY26), with net profit rising 11.87% year-on-year to ₹4,116 crore, driven by robust growth in the Retail, Agriculture, and MSME (RAM) segments, improved asset quality, and strong capital buffers.

The bank’s total business stood at ₹22.14 lakh crore, a 5.01% YoY increase, supported by a 6.83% rise in gross advances and 3.63% growth in deposits. Global deposits reached ₹12.39 lakh crore by the end of Q1FY26.

Key Highlights:

🔹 RAM Segment Boom:

The RAM segment saw a 10.34% YoY growth, with Retail lending up 25.63% and MSME lending up 17.65%. RAM now constitutes 58.11% of domestic advances, signaling strong retail focus.

🔹 Asset Quality Improves:

Gross NPA fell sharply by 102 bps YoY to 3.52%, and Net NPA dropped 28 bps to 0.62%, indicating better credit discipline and recovery.

🔹 Capital Position Strengthens:

The bank’s CRAR improved to 18.30%, up from 17.02% a year earlier. CET-1 capital ratio also rose to 15.30%, ensuring healthy capital adequacy.

🔹 Profitability Metrics Hold:

Return on Assets (RoA) stood at 1.11%, and Return on Equity (RoE) at 15.15%, reflecting sustained profitability.

However, Net Interest Income declined 3.18% YoY to ₹9,113 crore, and Operating Profit dropped 11.26% YoY to ₹6,909 crore due to lower treasury income and higher costs.

Financial Inclusion & ESG Commitments:

Union Bank continued its leadership in government-backed financial inclusion schemes:

PMJDY Accounts grew to 3.26 crore with deposits of ₹13,089 crore.

Over 5.1 lakh new enrollments under PMSBY and 4.35 lakh under PMJJBY.

Atal Pension Yojana (APY): 1.73 lakh new enrollments.

Women Entrepreneurs: ₹503 crore sanctioned under Union Nari Shakti.

Green Lending: ₹29,782 crore to renewable energy sector; ₹1,006 crore under Union Green Miles.

Branch & Service Network:

The bank operates 8,649 branches, 8,976 ATMs, and 24,907 BC points across India, enhancing access to financial services in rural and semi-urban areas.

Summary: Union Bank’s Q1FY26 performance reflects a steady growth path with improved credit quality, aggressive RAM expansion, and a deepening of financial inclusion. While margins were under pressure, the bank’s operational resilience and capital strength remain key positives.

all bankers Join us – Latest Banking updates

all bankers Join us – Latest Banking updates

Leave a Reply