Author: admin@thebankingtimes.in

-

SBI Research Maps India’s Oil Shift: From Russian Surge to Middle East Comeback Amid Tariff Tensions

Context: A proposed 25% tariff on Indian goods trade by the US—reportedly with scope for an additional 25%—would be a costly, counter-productive policy for businesses and consumers on both sides. India’s most pragmatic response is deft diplomacy and negotiation that safeguards national pride while minimizing trade disruption. India’s oil strategy since 2022 To ensure energy…

-

SBI Q1FY26 Results: Detailed Analysis

1. Profitability State Bank of India (SBI) delivered a resilient quarter in Q1FY26 despite pressure on margins. Net Profit rose to Rs. 19,160 crores, registering a 12.48% YoY growth. Operating Profit stood at Rs. 30,544 crores, up 15.49% YoY. Return on Assets (ROA) at 1.14% and Return on Equity (ROE) at 19.70% indicate robust profitability.…

-

Goldman Sachs Lowers India’s Growth Forecast Amid US Trade Tensions

Global investment bank Goldman Sachs has revised India’s growth forecast downward for 2025 and 2026, pointing to growing trade tensions with the United States after President Donald Trump announced a 25% tariff on Indian exports. While the direct economic impact of the tariffs is still unfolding, the bigger concern, according to the firm, is policy…

-

SBI climbs to 163rd rank in Fortune Global 500 list 2025

State Bank of India (SBI) has made a remarkable jump in the 2025 Fortune Global 500 rankings, securing the 163rd position, up from 178 last year. With this, SBI remains the highest-ranked Indian bank in the prestigious list. India’s presence in the 2025 Fortune Global 500 Nine Indian companies made it to this year’s list.…

-

RBI to absorb ₹3 trillion via VRRR auction to curb surplus liquidity

Mumbai, August 7, 2025 – The Reserve Bank of India (RBI) announced plans to conduct Variable Rate Reverse Repo (VRRR) auctions to withdraw ₹3 trillion from the banking system. This move is aimed at managing the excess liquidity in the financial system and ensuring short-term interest rates remain aligned with the central bank’s monetary policy…

-

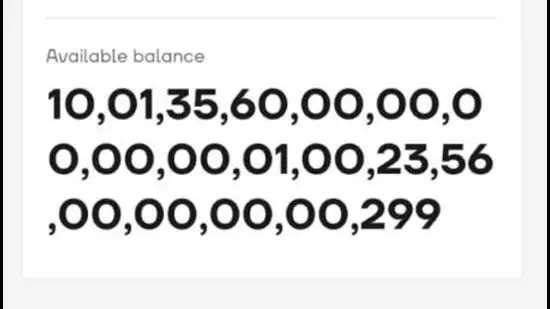

Greater Noida Youth Shocked to See ₹1.13 Lakh Crore in Bank Account Due to Technical Glitch

An 18-year-old student from Greater Noida was left stunned after discovering a balance of nearly ₹1.13 lakh crore displayed in his bank account through a mobile banking app on Monday afternoon. The youth, Dalip Singh, a Class 12 student from the Unchi Dankaur area, had logged into the Navi App linked to his savings account…

-

NABARD and RBI Boost Rural Financial Literacy; 2,421 Financial Literacy Centres Established Across India

In a strong push towards financial inclusion and responsible lending, the National Bank for Agriculture and Rural Development (NABARD) and the Reserve Bank of India (RBI) have initiated multiple programs to enhance financial literacy and streamline access to microfinance in rural areas. Key Financial Literacy Initiatives To empower rural communities, especially microfinance borrowers, NABARD and…

-

Cashless Treatment Scheme For Road Accident Victims Launched Across India

The government has officially launched the Cashless Treatment of Road Accident Victims Scheme, 2025 on a national scale. It was notified via S.O. 2015(E) on 5th May, 2025, with detailed guidelines issued under S.O. 2489(E) dated 4th June, 2025. Free treatment up to Rs. 1.5 lakh for victims Under this scheme, any road accident victim…

-

Effectiveness and Utilisation of the e-Shram Portal

In a significant move to streamline worker identification and remove fraudulent entries, the government has successfully identified and deleted 2.11 crore fake or duplicate worker records from the e-Shram portal. The e-Shram portal, designed to centralise and authenticate information about unorganised workers across the country, has so far registered over 40 crore workers. Integration with…

-

SBI and ministry streamline MPLADS with eSAKSHI portal for transparent fund management

The ministry of statistics & programme implementation, in collaboration with the state bank of india (sbi), has revolutionized mplads fund management through the esakshi digital platform. The eSAKSHI web portal, launched on 1st april 2023, integrates three key stages of the mplads workflow — mp recommendations, sanctioning by district authorities, and execution by implementing agencies…