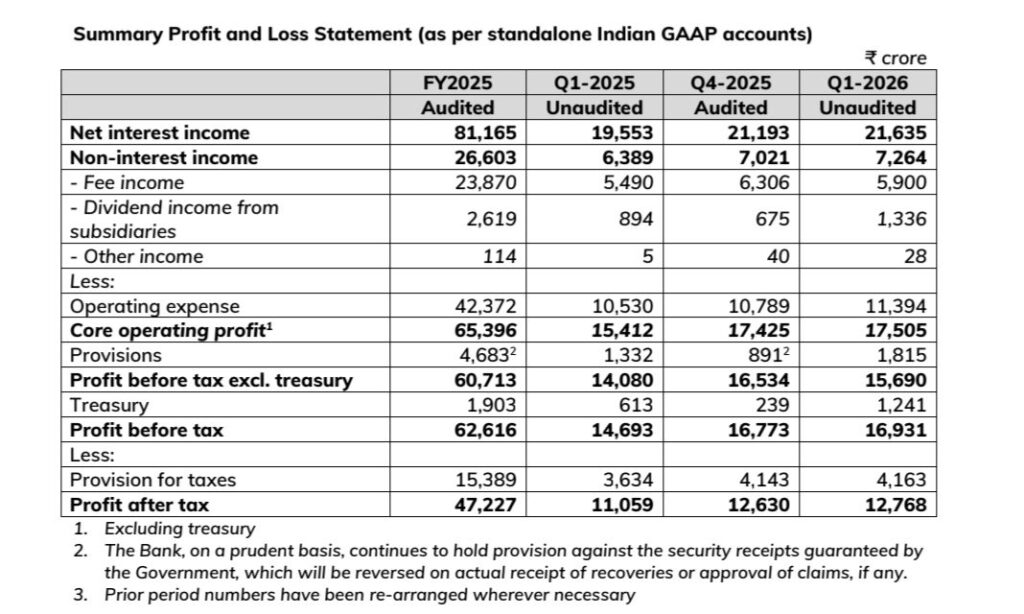

Mumbai, July 19, 2025 — ICICI Bank reported a strong financial performance for the quarter ended June 30, 2025 (Q1FY26), with a 15.5% year-on-year (YoY) rise in net profit, reaching ₹12,768 crore. This was supported by robust growth in core operations, steady credit expansion, and improved asset quality.

Key Financial Highlights:

Net Profit: ₹12,768 crore, up 15.5% YoY

Core Operating Profit: ₹17,505 crore, up 13.6% YoY

Net Interest Income (NII): ₹21,635 crore, up 10.6% YoY

Net Interest Margin (NIM): 4.34%

Non-Interest Income: ₹7,264 crore, up 13.7% YoY

Total Deposits: ₹16.08 lakh crore, up 12.8% YoY

Domestic Loan Portfolio: ₹13.31 lakh crore, up 12.0% YoY

Gross NPA Ratio: Down to 1.67% from 2.15%

Net NPA Ratio: Improved to 0.41%

Capital Adequacy Ratio: 16.97%, CET-1 at 16.31%

💼 Credit and Deposit Growth:

ICICI Bank’s domestic loan book expanded by 12% YoY, with notable 29.7% growth in business banking. Retail loans formed 52.2% of the total portfolio. However, the rural portfolio slightly contracted by 0.4%.

Deposit growth remained strong at 12.8% YoY, with a CASA ratio of 38.7%. Average current and savings deposits rose by 11.2% and 7.6%, respectively.

📉 Asset Quality and Provisions:

The bank further strengthened its asset quality:

Gross NPAs reduced to 1.67%

Net NPAs fell to 0.41%

Provision coverage ratio stood at 75.3%

Provisions for the quarter stood at ₹1,815 crore, higher than ₹1,332 crore in the same quarter last year, as the bank continues to build buffers.

🏢 Subsidiaries Performance:

ICICI Prudential Life Insurance posted a profit of ₹302 crore.

ICICI Lombard General Insurance saw a 28.7% rise in PAT to ₹747 crore.

ICICI AMC and ICICI Securities reported profits of ₹782 crore and ₹391 crore, respectively.

🧠 Strategic Focus:

With over 7,066 branches and 13,376 ATMs, ICICI Bank continues to invest in technology and digital platforms to enhance customer service and efficiency.

Summary:

ICICI Bank’s Q1FY26 results highlight its resilience amid a dynamic banking environment. Double-digit growth in profits and advances, alongside improving NPAs and strong capital levels, signal a confident and disciplined growth trajectory.

FOR QUICK BANKING UPDATES

FOR QUICK BANKING UPDATES

Leave a Reply